March in the Early spring

Feels the increasingly strong atmosphere of spring in Beijing

However, the chilly wind is hanging over Boston

The snowy scene can be seen outside the Harvard Business School

While it is warm inside the Business School

The doctor graduated from the School of Management in 1996,

Song Zhiping (Chairman of China National Building Materials Group), comes for the agreement of one decade

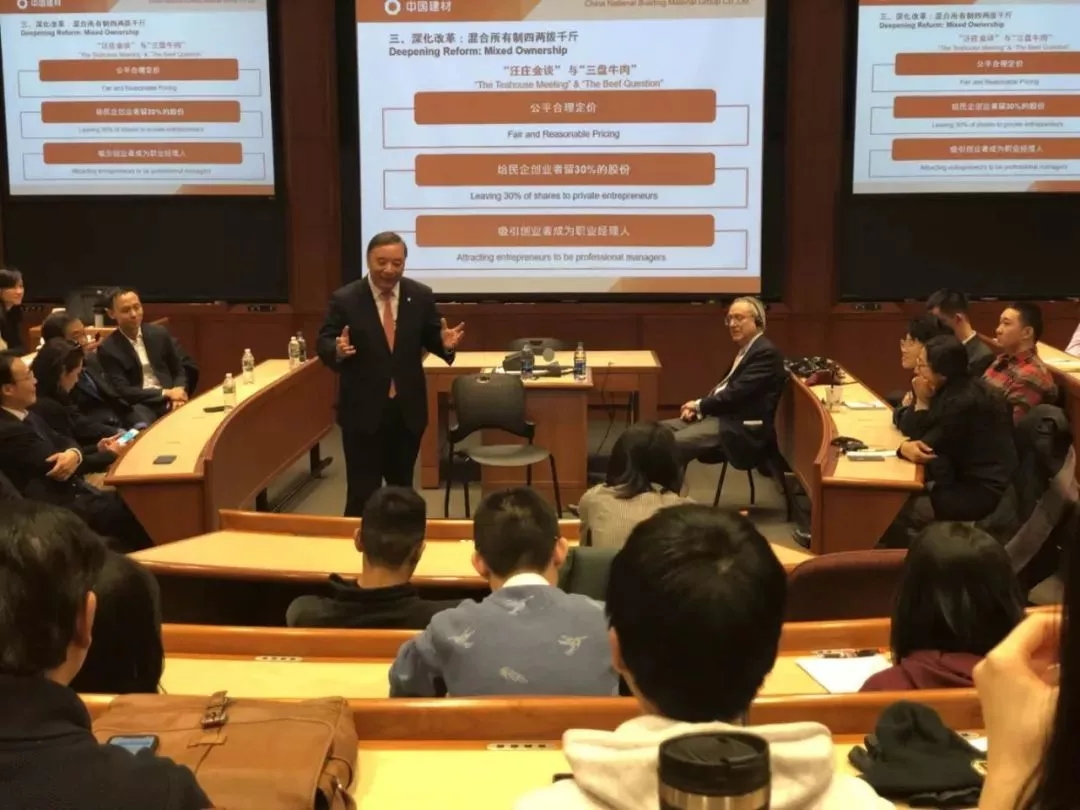

And make the case speech entitled "Merger and Integration of Chinese Style"

All the seats are taken in the classroom with a warm atmosphere

Wonderful memoir sharing:

Merger and Integration of Chinese Style

Song Zhiping, Chairman and Secretary of the Party Committee in China National Building Materials Group

It's a great pleasure to come to Harvard Business School and have a talk with all our teachers, students and friends today. I'm grateful for the arrangement by Harvard Business School. And the gratitude shall also be presented to Professor Powell and everyone here to attend my presentation.

Then, what is the agreement of one decade?

Professor Powell and I agreed one decade ago that I would give a case speech at Harvard Business School as he hoped. As you know, I'm a leader of the central enterprise. It's not realistic to exclusively give a speech in the Harvard Business School. This time, I need to give a speech on climate and environment as president of the World Cement Association for World Bank in Washington. Professor Powell suggested that I finish what I promised one decade ago, come to the Harvard Business School, and talk about the growth of China National Building Materials Group to our students. I think it's great because it will fulfill my long-cherished wish for years. Today, I came to the Harvard Business School so early to take a walk around the whole school. And the beauty of Harvard Business School impressed me so much. It's a blessing for all of you to study in the Harvard Business School. Meanwhile, I have never imagined that Boston is so cold. But the whole room here feels so warm and harmonious, and I'm going to tell you about the story of China National Building Materials Group and my own experience.

How many stages were there for my 40 years of enterprise experience?

I majored in Polymer Chemistry. When I graduated from university in 1979 and came to Beijing, I didn't expect to be assigned to a plant of building material. I thought it was a right choice to come to Beijing, but a wrong choice to enter a plant of building materials. It has been 40 years since I had been working in the field, while now, when I recall the memory, it was right to enter the plant of building materials as well. I have been working in the enterprise for 40 years from the age of 23 to 63. In the past 40 years, I have actually done one thing: to operate the enterprise, China National Building Materials Group, with all my efforts. My life experience can be divided into several stages:

In the first stage, I worked in a factory called Beixin Building Materials, which is still a good listed company now. It is the largest gypsum board company in the world. Last year, it achieved a good profit of more than RMB2,000,000,000. I worked for 23 years there, from technicians and salesmen to factory directors. And the factory was in my charge for 10 years.

Then, I came to China National Building Materials Group 17 years ago. China National Building Materials Group is the parent company of Beixin Building Materials and a central enterprise. I have been in the enterprise for 17 years until now.

From 2009 to 2014, I served as the chairman of two central enterprises, China National Building Materials Group and chairman of building materials and China National Pharmaceutical Group Corporation, simultaneously. I served as the chairman in the two enterprises for 5 years, which is my work experience.

How did I succeed in operating the two Fortune 500 enterprises

Every time when I appeared, whether as the factory director of Beixin Building Materials, the general manager of China National Building Materials Group, or the chairman of China National Pharmaceutical Group Corporation, there were a lot of difficulties for such enterprises, for which I appeared in them. Therefore, I often think it is the destiny. I'm so envious of those who did it smoothly in making things even better every time, while my experience started from difficulties. We always say, "I spend one effort for one achievement", while for me, it is "ten efforts for one achievement". 40 years of enterprise operation witnessed all of my efforts. The achievement I gained is the success of two Fortune 500 enterprises.

17 years ago, the revenue of China National Building Materials Group was less than RMB2,000,000,000, while the number has reached RMB350,000,000,000 by last year. The revenue of China National Pharmaceutical Group Corporation was RMB36,000,000,000 when I served there as the chairman in 2009, and the number reached RMB250,000,000,000 when I left in 2014. By last year, the number has reached RMB400,000,000,000. In 2011, China National Building Materials Group was included in the Fortune 500, and China National Pharmaceutical Group Corporation followed suite in 2013. Then, I served as the chairman of two groups. This is a picture of me and the general managers of two groups when we were receiving an award. The picture above is of significance as a milestone, symbolizing the development of Chinese enterprises. As you know, 29 years ago, there was only one fortune 500 enterprise in China. Last year, the number was 120, and there were 126 in the United States. I don't know how there will be in China in this year. I'm sure there will be several more.

How to operate an enterprise successfully?

The past 40 years has witnessed the tremendous changes in China's enterprises, but how such changes happened and what the internal reasons are there to motivate the changes In fact, not all the people are completely clear about this issue. For example, in my enterprises, the employees often ask, "Chairman Song is s leader of central enterprises. Do his enterprises involve monopolization? Do his enterprises rely on state power to grow up?" Today, I will tell you about that frankly. In fact, every time I appeared the when such enterprises were facing difficulties. 17 years ago, when I was in charge of the enterprise in 2002, on the rostrum where I took office, the office director ran up to me and gave me a document, the notice of banks freezing all the assets of the enterprise. Everyone asked how many assets the company had then. The company was insolvent with an income of only RMB2,000,000,000. I took the post of general manager under such a circumstance. Through 17 years of painstaking efforts, China National Building Materials Group has developed into the largest enterprise of building materials in the world.

Everyone asks, "How did you make it, and by what means can a person achieve such a success?" I want to tell you that, as a matter of fact, we made it under the support from the reform over these years. Sometimes, people ask, "How did the enterprise develop and flourish?" Many people say they benefited from the government's favoritism, but it never went on that way. Many state-owned enterprises in China lost their edges in the first round when entering the market, and many enterprises fell down in the market competition. A great number of employees were laid off and experienced a very severe market-oriented reform with their former enterprises. In the harsh market-oriented reform, some enterprises survived, marched bravely toward the market, and thereby becoming some of the well-developed state-owned enterprises today. The state-owned capital accounts for only 25% in China National Building Materials Group, while social capital, non-public capital and shareholder capital account for 75%. I often tell my peers that, in fact, it is market reform that can save such enterprises. Without the market reform, either China National Building Materials Group or China National Pharmaceutical Group Corporation, all such enterprises might have gone bankrupt. The reasons for which I talk about this to everyone is that some media and experts don't fully understand the process therein. A few days ago, I told some experts from the World Bank such principles. The survival and prosperity of Chinese state-owned enterprises today is attributable to the reform.

Do you like cement?

When I ask "Do you like cement and understand cement?", all of you laughed. It seems that you neither like it nor understand it. Nor did I 17 years ago, because I used to be engaged in the new building materials and gypsum boards in Beixin Building Materials. Then, I was against using more cement because, I thought, more new building materials shall be applied. I also wrote some articles about it. But how funny the destiny is. It's I who was appointed the "leader" in China National Building Materials Group. Then, what is the business for China National Building Materials Group? What is the largest industry in the field of building materials? All of you will answer "cement". Right, Chairman Song does the business of cement. I was forced to do the business of cement. I hated it, and then liked it. So far, I have become the "King of Cement" in the world.

The day before yesterday, I mentioned to the officials of World Bank, "Whether you like cement or not, I love it now, because cement is a great thing." Human beings have made copper for more than 4,000 years, iron for 2,500 years, while cement for merely 180 years. 180 years ago, there was no such thing as cement. The construction in Paris was done with stone rather than cement; the cities like St. Petersburg were also constructed with stone; for the Forbidden City in China, it was constructed with bricks. But since the invention of cement 180 years ago, it has provided a huge support for the infrastructure construction in our cities. Without cement, we can't imagine what our life and urban construction will be like now in China. A lot of wood and steel are used as the building materials in the United States, while we use a lot of cement in China. Because there are not so many wood in China, iron ore mainly depends on import, but limestone used for producing cement is everywhere. China is a coal-rich country, and coal is the main fuel for cement burning. Since China's reform and opening up, the construction in China has always been based on cement, such as the construction of Hong Kong-Zhuhai-Macao Bridge, as well as the construction in Shenzhen and other cities. Last year, 4.1 billion tons of cement were consumed globally, 2.2 billion tons among which were consumed in China. Without cement, the construction today cannot be carried on.

Today, we are talking about "Belt and Road Initiative". In fact, the first thing to do for the implementation of "Belt and Road Initiative" is concerned with cement, because there are two things we shall carry out in the "Belt and Road Initiative", i.e. urbanization and industrialization. Either urbanization or industrialization needs infrastructure. We say, "transportation is the prerequisite of the wealth". Therefore, all such constructions depend on cement. In the past, we often said, "the provisions shall be prepared before a military action". What is the provision for the "Belt and Road Initiative"? Cement plants. Just now, we have seen so many cement plants on the map built by China National Building Materials Group, that is to say, before the "Belt and Road Initiative", China National Building Materials Group has laid out a great number of cement plants, which is the work done by China National Building Materials Group.

After talking about the enterprise and my personal information, you will naturally come up with a question: how did the small company without any reputation, whose revenue was only RMB2,000,000,000 17 years ago, managed to become the "King of Cement" in the world, and what happened during the period? I'm here to share the content concerning that with you.

I. Historical Background: From Shortage Economy to Surplus Economy

First of all, I would like to talk about the process of China's economy and marketization. 40 years ago, what China faced was the shortage economy. The annual output of cement was merely 70 million tons (less than 100 million tons). With the development of reform and opening up for 40 years, most of the industries in China are in surplus, including the industry of cement. I just said that China sold 2.2 billion tons of cement last year, but do you know the capacity of cement in China? 3.5 billion tons, a huge deal of surplus. In fact, it is not only the cement. Many of the industries in China are facing the same problem. That is to say, we used to talk about "post-industrialization". In fact, we have unconsciously entered the era of "post-industrialization". Most of the manufacturing industries are in surplus, and, for cement, it is more serious. Cement is a "short-leg" product, which means that it is not suitable for long-distance transportation, with a reasonable transportation radius of about 200km; it is not suitable for storage, whose storage duration is only 3 months. With the surplus, a series of problems will occur. When I started to take the post of general manager in China National Building Materials Group, many people advised me to do the business of cement. In fact, I had never done it before, but I thought they were right, and I should try the business. When I was preparing to be listed in Hong Kong, and the consultants of capital market asked me, "Mr. Song, do you want to do the business of cement really?" "Yes", replied I. They said, "first, if you want to do the business of cement, and does your company have enough money? Second, do you understand how to do the business of cement, and by what means you can manage the business?" In fact, this was not only a matter of concern for them, but also a question I often asked myself. Cement is an asset-heavy investment. Any cement plant needs an investment from RMB1,000,000,000 to RMB2,000,000,000. How a poor enterprise like that could do the business of cement was the problem I faced.

However, What I saw then was the status quo of "redundant" (serious surplus), "disperse" (low concentration) and "disordered" (disordered competition) of the cement industry in China, which provided us with the opportunity to do the business of cement, that is, the opportunity of joint and reorganization later. At the beginning of the last century, there were more than 2,000 steel enterprises in the United States. The competition then was also disordered, which was similar to the cement industry in China. Mr. Senior Morgan launched a reorganization which reorganized 65% of the steel enterprises in the United States. In that case, we had no choice but to reorganize. There should be someone cheering up and allying the enterprises to solve the problem, who also created an opportunity for enterprises to grow. Most of the large enterprises across the world were developed by reorganization all the way, while in China, the word "merger" couldn't be used simply. The Chinese didn't like the word "merger" because people would think "how dare you merge me?", and thus we found a suitable word, called "joint and reorganization". When an enterprise was reorganized by us, we would say that we should strengthen the alliance, which is a kind of emotionally acceptable way.

Market competition is efficient, but market economy is a kind of surplus economy which is not perfect. The market economy is a method we choose now. Because of the disorder and surplus of the market economy, we used to adopt the planned economy in the past, but the planned economy became a kind of shortage economy. Because of the low efficiency, we chose the market economy again.

II. Only Way: Integration of the Market with the Hand of Large Enterprises

First of all, I would like to talk about the process of China's economy and marketization. 40 years ago, what China faced was the shortage economy. The annual output of cement was merely 70 million tons (less than 100 million tons). With the development of reform and opening up for 40 years, most of the industries in China are in surplus, including the industry of cement. I just said that China sold 2.2 billion tons of cement last year, but do you know the capacity of cement in China? 3.5 billion tons, a huge deal of surplus. In fact, it is not only the cement. Many of the industries in China are facing the same problem. That is to say, we used to talk about "post-industrialization". In fact, we have unconsciously entered the era of "post-industrialization". Most of the manufacturing industries are in surplus, and, for cement, it is more serious. Cement is a "short-leg" product, which means that it is not suitable for long-distance transportation, with a reasonable transportation radius of about 200km; it is not suitable for storage, whose storage duration is only 3 months. With the surplus, a series of problems will occur. When I started to take the post of general manager in China National Building Materials Group, many people advised me to do the business of cement. In fact, I had never done it before, but I thought they were right, and I should try the business. When I was preparing to be listed in Hong Kong, and the consultants of capital market asked me, "Mr. Song, do you want to do the business of cement really?" "Yes", replied I. They said, "first, if you want to do the business of cement, and does your company have enough money? Second, do you understand how to do the business of cement, and by what means you can manage the business?" In fact, this was not only a matter of concern for them, but also a question I often asked myself. Cement is an asset-heavy investment. Any cement plant needs an investment from RMB1,000,000,000 to RMB2,000,000,000. How a poor enterprise like that could do the business of cement was the problem I faced.

However, What I saw then was the status quo of "redundant" (serious surplus), "disperse" (low concentration) and "disordered" (disordered competition) of the cement industry in China, which provided us with the opportunity to do the business of cement, that is, the opportunity of joint and reorganization later. At the beginning of the last century, there were more than 2,000 steel enterprises in the United States. The competition then was also disordered, which was similar to the cement industry in China. Mr. Senior Morgan launched a reorganization which reorganized 65% of the steel enterprises in the United States. In that case, we had no choice but to reorganize. There should be someone cheering up and allying the enterprises to solve the problem, who also created an opportunity for enterprises to grow. Most of the large enterprises across the world were developed by reorganization all the way, while in China, the word "merger" couldn't be used simply. The Chinese didn't like the word "merger" because people would think "how dare you merge me?", and thus we found a suitable word, called "joint and reorganization". When an enterprise was reorganized by us, we would say that we should strengthen the alliance, which is a kind of emotionally acceptable way.

Market competition is efficient, but market economy is a kind of surplus economy which is not perfect. The market economy is a method we choose now. Because of the disorder and surplus of the market economy, we used to adopt the planned economy in the past, but the planned economy became a kind of shortage economy. Because of the low efficiency, we chose the market economy again.

III. Reform Intensification: Change the Status Quo Easily with Mixed Ownership

Some of you also asked, "How did Chairman Song make it, and by what means did he reorganize those enterprises, and where did his money come from?" Before the reorganization, my colleagues asked, "Chairman Song, where is the money for reorganization?" During the reorganization, many people asked, "Chairman Song, do you have the money?" Until now, someone asked me, "Chairman Song, how much did you borrow?" Without money, we could not do such things, because it would take too much in reorganizing the cement industry. So what methods did I adopt? I adopted a method of mixed ownership of capital, that is to say, to operate enterprises with the reorganization of resources and utilize the capital with the mixed ownership.

As I said at the beginning, the state-owned capital in China National Building Materials Group only accounts for 25%. The 25% is actually the money earned by the enterprise in the past 17 years. Because the enterprise did not have any capital 17 years ago, we made RMB50,000,000,000 in the past 17 years, and then absorbed RMB150,000,000,000 from the social capital. With RMB200,000,000,000, which was matched with some loans, we formed a total asset of RMB600,000,000,000 in China National Building Materials Group. That is what I did. Everyone asked, "How did China National Building Materials Group bring these private enterprises in? They are so shrewd. Why would they come to you?" I'm going to answer the question as well. When I became the "leader" in China National Building Materials Group, I received the notice of asset freezing from banks on the rostrum. Sometimes, the reality is more dramatic than dramas. It's hard for a scriptwriter to think of such a scenario, which can only be produced in reality. I was also thinking about how to operate the central enterprise. After painstaking consideration, I came up with a solution, "to operate a central enterprise based on market economy". It was the solution that saved the enterprise and solved the problem of enterprise development.

Although China National Building Materials Group is a central enterprise, but as a state-owned enterprise in the field of full competition, you will enjoy your success if you do it well; Or otherwise, you will be discarded by the market. For an enterprise facing such situation, the only way it can choose is to stride toward the market. Everyone will ask, "What is the content of 'to operate a central enterprise based on market economy'"?

"Central enterprise" refers to a state-owned enterprise that bears economic, political and social responsibilities. Concerning "based on market economy", I thought of five items: first, the mixed ownership: to carry out the shareholding reform and attract social capital; second, standardization of corporate system; third, implementation of the professional manager system, without which no one would work hard; fourth, establishment of a good internal mechanism: we should learn from private enterprises in such respect; fifth, fair competition based on the market rules, that is, the neutrality principle of market competition we talk about today. That was what I thought of 17 years ago. China National Building Materials Group, as a central enterprise, should be willing to compete equally with private enterprises and foreign-funded enterprises in the market. It should not wait for the favorable policies or rely on the partiality from government. Instead, it should rely on its own skills, or win, or otherwise, we will be regarded as a parasite to the country if we win; if we lose, people will think we deserve it, "he lost as a state-owned enterprise eventually". In a word, it would not be fine. Now the word "competitive neutrality principle" is very hot. State-owned enterprises shall abide by the principle. In fact, I did it following the idea 17 years ago. Fortune Magazine interviewed me when they heard about the news. I systematically told them what is "to operate a central enterprise based on market economy" and why a central enterprise should adopt the market-oriented operation.

In 2013, I had a dialogue at the Wealth Conference held in Chengdu. The host, Mr. Stephen Roach, is now a senior professor at Yale University and used to be the chief economist of Morgan Stanley. The dialogue was named as "state-owned enterprises and private enterprises", which was a very sensitive topic then. Fortunately, Roach is a thinker. He asked me, "Mr. Song, here is what I want to ask you: your state-owned enterprises in China flourish and are still very vital. Did they benefit from the reform going public 20 years ago?" I said, "Mr. Roach, your question happens to be the answer. We were forced to go public 20 years ago in order to find money. But I didn't expect that after going public, we changed our internal system deeply. In the past, we changed from a state-owned enterprise to a listed company and public company, and thereby transforming into a company with social shareholders and shareholders."

After going public, I said something. It was in 1997 when Beixin Building Materials was listed that the media widely published: Song Zhiping said, "going public is wonderful, while it will also be painful".

Then what is wonderful? Facing a check representing so much money I had never seen all of a sudden, I counted the number by the decimal point. After the counting, I said, "give me a copy, and I want to save it". I had never seen so much money in deed; I added, "I hope to issue shares again in ten years, and there will be one more zero." Some of my words came true. Ten years later, when China National Building Materials Group was listed in Hong Kong, there was an extra zero. Why would I say "painful"? Because after going public, the mechanism for shareholders to enter the enterprise will be changed, different from what the state-owned enterprises did traditionally, which was not easy to change. If a traditional state-owned enterprise wants to transform into a state-owned enterprise that meets the requirements of shareholders, it shall undergo a thorough transformation. I'm wondering if you have an idea about what it means by "thorough". If there is a small wound on our hands, we will suffer from it so much. Therefore, we indeed suffered from the "painful" experience which changed all our "organs" "thoroughly". It was just with the "painful" transformation that our enterprise realized a Phoenix-Nirvana-like rebirth. The enterprise has realized the marketization, been listed and accepted the mixed ownership. Such experience is so important for state-owned enterprises.

When it comes to how to operate China National Building Materials Group, I think of how Beixin survived such difficulties. The first thing is to go public. When I said that China National Building Materials Group should go public, my colleagues all thought, "Is Chairman Song out of his mind today? Why would he think of going public?" One day, I read a newspaper 21st Century Business Herald in my office in the morning. It was a relatively avant-garde newspaper then. I ordered the newspaper and read it every day. There was not much business then, and the assets were frozen by the court. I read this newspaper to kill time. All of a sudden, I found an exciting piece of news in it. It reads that domestic A shares and some profitable capital could be packaged to be listed in Hong Kong. I wanted to be listed as soon as I saw the opportunity. I informed that there would be a meeting of the leading group in the afternoon. I thought why the time was so slow. In the morning, I was walking around the room alone, and a good idea came to me. In the afternoon, I held a meeting and found that all my colleagues looked at me strangely. I said, "I know why you look at me this way, because none of you believe that we can be listed in Hong Kong, but I faithfully believe that we can make it." Why? Now the concept of China is very hot all over the world. I went to Davos in 1997. There were voters in Davos then. When being asked where the economic hot spot would be in the next ten years, we voted. More than 90% of us were looking at China. I was extremely impressed. That is to say, the capital across the world was optimistic about China. This is the background when I wanted to go public in 2004.

When going public, we needed to find the investment banks. When it came to going public, the investment banks were very enthusiastic. They were very happy when they came, but all of them left after seeing the company's financial statements. They said, "Chairman Song intends to go public always, but it seems that he can't get on with it." It was so hard to appeal to Morgan Stanley, and he gave up halfway. We had a team for going public then, and I would talk to them once a month the way I talk to you today. I said, "We are sure to be listed. I understand those listed companies in Hong Kong. We will not be the worst if we are listed there. At least, we are in the middle or even upper level. What we lack now is just the ticket. Our task is to get the ticket." My words came true. We were warmly welcomed to go public in Hong Kong as I thought, because they thought China's economy was developing rapidly and the concept of China National Building Materials Group was out of the question. Song Zhiping from China National Building Materials Group told a story that his enterprise would become the "King of Cement" in the world and reorganize the cement industry in China, and everyone voted for it. The share price of the company rose from the issuing price of HK$2.75 to the highest price of HK$39 Yuan, and everyone supported it. When we got the money, we went acquiring the enterprises in China.

Once upon a time, I met a person in charge of an investment bank in Singapore. He said, "Chairman Song, you are very interesting. First, you told us a story, and then your company's shares rose. After that, you issued the shares, and went back to Beijing to finish the story you had told us." I said, "You're right. That's what I am. Is there any problem?" I went back to Hong Kong and told another person in charge of an investment bank that I was asked about such things by a person in Singapore this time. The head of investment bank in Hong Kong said to me, "Chairman Song, you are right. That's what you did. The capital market operates this way. Everyone buys a good concept." However, the money I took is still a drop in the bucket compared with the required funds for acquisition of cement enterprises. It was just a YaoYinZi. What should I do next? I wanted to acquire so many cement plants. Without so much money, I thought of the mixed ownership and left some shares to the acquired private enterprises.

I was reading a book then, Mind Set! by Naisbitt. There is a point in Mind Set!: you have to take out "beef" when reforming. That is to say, what are the benefits of the reform? If I want to acquire so many private enterprises, what shall be the benefits for them? I should figure it out before I talk about it. I figured out what the "beef" is, and I had "three plates of beef":

First, fair pricing. Although I am a state-owned enterprise and you are a private enterprise, I will not bully you, instead, I will give you some premium. I have a theory of "hen". If the chicken lays eggs, I will pay for eggs for extra two months. The eggs laid later will belong to me. This is my simple theory. If it's a rooster or broiler, I have to be careful. But if I acquire a hen, I don't have to be. Therefore, fair pricing makes everyone feel comfortable.

Second, 30% of the shares should be left to the private enterprises acquired. In the past, you owned 100%, but you faced a malicious competition. In some places like Zhejiang, the competition devalued cement from RMB400/ton to RMB200/ton, which damaged the profit for everyone. However, if you cooperate with me, you will a lot of money on the one hand, and share more money in the future, although you only retain 30% of the shares. Think about it. It's better to be in the black with 30% of the shares than to be in the red with 100% of the shares.

Third, professional managers. These people have been doing the business of cement for a lifetime. What shall they do with so much salary? So I said, "you all stay here to be professional managers of China National Building Materials Group.". I was also asked then, "How did you gather so many managers for so many enterprises acquired?" I replied, "everything comes from the market," and they stayed.

The first time when I talked about the "three plates of beef" was in Hangzhou. There were two hotels beside the West Lake in Hangzhou, one of which was Liuzhuang and the other was Wangzhuang. Because there was a beautiful tea room by the lake of Wangzhuang, I chose Wangzhuang. I called the four so-called magnates of cement in Zhejiang Province there to have tea with them, and eventually convinced them by the evening. They were competing with each other then. In the process of competition, many of other sides were optimistic about the matter in fact, and provided "olive branch" to them. Some of them even paid deposits, while the others had entered the field to do the due diligence. I told them a truth, "you four are competing with each other, and if four "mercenaries" are invited now, your competition will be increasingly fierce. Why don't you all cooperate with me? If you unite, the competition will terminate. What's more, how delicious my "three plates of beef" is. After a whole day of negotiation, they accepted my concept and felt that Chairman Song was right. One of them who was going to Malaysia the next day to sign an agreement went out and made a phone call to return the ticket. I knew that this method was really good. This is the "Wangzhuang Negotiation", which is a well-known story for the building material industry in China, because the negotiation directly contributed to the reorganization of cement industry by China National Building Materials Group. Since then, the large-scale reorganization began.

Once upon a time, a senior leader of the former Building Materials Bureau said to me on the plane: "Zhiping, everyone told me that I shouldn't meet Song Zhiping during this voyage to the South. If I meet you and talk with you for 20 minutes, I will have to follow you". I said, "I'm not a fairy, and they're not children who just follow me if I give them a piece of candy. Only if what I say is right and caters to their interests, they will follow me." My reorganization was actually done by such means, which is a mutually beneficial and win-win method. We reorganized thousands of enterprises. So far, there have been 9 regional cement companies with a capacity of 530 million tons, forming the largest cement corporation in the world. Last year, we made a lot of money. For example, our South Cement Company Limited achieved an after-tax profit of RMB10,000,000,000. Is there any other business that can achieve an after-tax profit of RMB10,000,000,000? Name it. Now, we frequently talk a lot about the new internet economy. In fact, if the real economy is done well, the profit will also be quite high. Just like cement, all of us have forgotten it. No one imagined that a company of the cement industry can make an annual profit of RMB10,000,000,000.

I tell the story because I used mixed ownership in the reorganization. Mixed ownership is a good thing. Now, China is holding the "Two Sessions". In the report of Premier Li Keqiang for the "Two Sessions", he wrote "actively and steadily promote mixed ownership". Last year, he wrote "steadily promote mixed ownership". The year before last, he wrote "vigorously develop mixed ownership". Chinese vocabulary is so rich. But this year, the word "actively" is added compared with that in the last year. Last year, it was called "steadily", and "vigorously develop" means accelerating, while "steadily" means slowing down and being cautious. This year, "actively" is added before "steadily", indicating that "steadily" alone is enough, and we need to work faster. I am the pioneer in adopting mixed ownership. In 2014, China implemented the mixed ownership. The state selected two pilot enterprises, one of which is China National Building Materials Group, and the other is China National Pharmaceutical Group Corporation. Both of them The mixed ownership for both of them was introduced by me, and the national pilot just selected the two companies.

I have written a book called Synchronous Progress of State-owned Economy and Private Economy. I don't think that we should "advance the state-owned economy and retreat the private economy" or "advance the private economy and retreat the stated-owned economy". Mixed ownership means the synchronous progress of the state-owned economy and private economy. Why? Because there was no way found about how to integrate the state-owned economy and the market economy before. Everyone has been discussing this issue all over the world. No country in the West has ever carried out the nationalization movement, nor has them carried out the privatization movement. All the countries are indeterminate on whether to nationalize or to privatize. In France, for example, in the era of Mitterrand, the nationalization movement was carried out. Later, the Right came to power and carried out the privatization movement. Now there are more than 50 state-owned enterprises, of which more than 20 are purely state-owned for public welfare undertakings; more than 20 of the others belong to mixed ownership. Renault, for example, has a 25% of shares belonged to the state; Gaz de France has 36% of state-owned shares. I used to ask the head of the French State-owned Assets Administration, "Why don't you just privatize the enterprises of mixed ownership?" "Our country also wants to make some money," replied he. I think they are similar to our SASAC in this aspect, who wants keep and increase the value of state-owned assets. In particular, China, as a socialist country, wants "Two Never-be-Shaken Principles". It's hard for westerners to understand why we would adopt "Two Never-be-Shaken Principles". The traditional culture of Chinese people has always been dialectics since Dao De Jing and The Book of Changes. The combination of Yin and Yang in the Diagram of the Universe includes a white fish and a black fish. They are very harmonious drawing together, and the combination is perfect. Chinese people know such truth. It's easier to run a private enterprise by sticking to "Two Never-be-Shaken Principles", while for a state-owned enterprise, by what means can we stick to the "Two Never-be-Shaken Principles"? There is a question "by what means".

The combination of state-owned economy and market is a global problem. A senior leader once said, "if anyone can solve the problem of China's state-owned enterprises, he shall be regarded as the contemporary Marx", which means it is very difficult. Nevertheless, with 40 years of the reform and opening up in China, I think the problem has been solved, and I understand how the state-owned economy can be combined with the market, that is, the "ternary form" we are now engaged in. First, SASAC manages capital rather than enterprises, and investors manage capital; Second, China National Building Materials Group is an investment company managing share capital; Third, the cement companies affiliated to China National Building Materials Group shall be operated under mixed ownership to put capital into state-funded investment companies. The investment companies invest share capital. The share capital can be more or less, and can be advanced or retreated. In the enterprises of mixed ownership, the share capital shall prevail. It provides the same power as any shareholder. In such way, the enterprises of mixed ownership are also competitively neutral and solve the problem. In fact, China's mixed ownership is pretty good, which provides a solution to the exiting mode of state-owned economy in the market. If it is a pure state-owned enterprise, the problems will arise in the market, because in the field of competition, if it is an enterprise wholly invested by the state taxpayer, there will definitely be a paradox for it to compete with taxpayers. But if the state investment company invests share capitals, it shall put some of the current capitals into the enterprise, which is acceptable for the market. All of us know about Temasek in Singapore, a state-owned investment company. It carries out the investment all over the world. No one says that the companies it invests are state-owned because it abides by the competitive neutrality principle. That's why I say mixed ownership is so good.

Mixed ownership also solved the long-term problem due to functional integration of government and enterprise in the state-owned enterprises. If an enterprise is 100% state-owned, can it be separated from the government? My answer is negative. If a company of mixed ownership becomes a listed company, the company will get the independence because a listed company has shareholders and non-public shares, which realized the functional separation of government and enterprise that we couldn't solve for a long period. Mixed ownership also solved the problem about how to introduce the market mechanism into enterprises. In the past, we always emphasized reform and that state-owned enterprises should introduce new mechanisms, nevertheless, the introduction always failed. However, the mixed ownership can bring in mechanisms of private enterprises and market, which can play a positive role. For example, when Yunnan Baiyao was reorganized two years ago, Yunnan SASAC accounted for 45%, the private enterprise, Xinhuadu, accounted for 45%, and another private enterprise accounted for 10%. Yunnan SASAC and Xinhuadu worked as the chairman of the board of directors for three years in turn. The mechanism was based on marketization rather than state-owned enterprise, which was totally a market-oriented approach and finally solved the problem. Only the mixed ownership can really solve the problem of mechanism in state-owned enterprises.

Looking at the state-owned enterprises in China today, the westerners can't understand them very well. Why can't they? Because they still regard the state-owned enterprises in China as the state-owned enterprises 40 years ago and as the state-owned enterprises in their minds in the past. In fact, the state-owned enterprises in China have changed a lot. There are 96 central enterprises in China, and 70% of their assets are in enterprises of mixed ownership, with a high degree of mixing. Of course, there is no need for some public welfare enterprises to adopt mixed ownership. In the west, they are also operating their such enterprises the way of state-owned enterprises, because such enterprises do not aim to make profits. For example, Beijing Public Transportation Group relies on government subsidies every year. Who is willing to invest? It can only be the government. Because a man at the age of 60 or above can take a bus for free, which belongs to public security. Such enterprises shall be owned by the state. Enterprises in the field of full competition can engage in the mixed ownership if the state is willing to do so. That's exactly the method. However, it took China 40 years to find the method. Why don't westerners adopt such method? They think the method is too troublesome. They think since the efficiency of state-owned enterprises is low, they should privatize all the enterprises and operate them simply.

I went to Berlin, Germany, the year before last, and the members of Parliament in Berlin said to me, "Chairman Song, our enterprises have been fully privatized in the 1990s, but now we find that it doesn't work well. Recently, our Berlin and Hamburg have nationalized all the railways, power plants and tap water." I asked, "Why?" They answered: first, such enterprises are not lucrative; second, the operation quality of such enterprises needs to be guaranteed. The tap water supply system in Berlin was constructed a hundred years ago, and now it has to be operated well by the state. The public welfare and security may shall still be operated by the state-owned enterprises. During the winter in northern China, several heating companies in some cities often supply heating a few days later and stop the supply a few days earlier. The heating temperature is not high enough. The problem arises due to the similar reason. I also suggest our government that, as a matter of fact, public welfare and security enterprises requiring subsidies shall only be operated by the state rather than being market-oriented. Nevertheless, the enterprises in the field of full competition shall engage in the mixed ownership. They do not have to be purely state-owned. China National Building Materials Group adopted such a method. Mixed ownership is a good thing. It found a way for the state-owned economy to enter the market and the way for the state-owned enterprises to introduce the market mechanism. That is what we have been doing for so many years. I am a practitioner, and I believe that practice can produce real knowledge.

IV. Integration Strategy: Combination of "Tao" (Principle) and "Shu" (Performance)

Everyone asks, "How did you integrate so many enterprises that you had reorganized?" I did a good job indeed. Generally speaking, the success rate of such reorganization is not very high, because the reorganization involves the problem of culture and integration, which are very complex. It will not be that easy to complete the integration. How did China National Building Materials Group manage the integration of them? We have our own logics in the reorganization. There are four principles of reorganization for China National Building Materials Group:

First, it shall be in line with the group's strategy. We don't need all sorts of enterprises. The transportation radius of cement is short, so we generally carry out the regional integration. For example, we don't have any cement plant in Beijing, because BBMG is there. We have no cement plants in Anhui either, because Conch is there. I tend to choose the places where there are many cement plants without powerful leaders to launch the reorganization. If we account for 60%-70% of the market share, we will own the speaking right and pricing power.

Second, the reorganized enterprises shall have potential profits. Perhaps, the reorganization itself can't make money, but after the reorganization, we shall make sure that the acquired enterprises will make money, a lot of money. We shall study and make sure that such enterprises meet the requirements before we decide to reorganize them. Any "hen" we acquired must be "fertile". If it doesn't lay any egg, why should we take it?

Third, there must be synergistic effect. For example, we have a plant in Xuzhou, which has two production lines with a daily output of 5,000 tons. Then, Conch builds a cement production of 10,000 tons next to our plant. The two enterprises will definitely compete with each other. With the competition, cement price will fall from RMB400 to RMB200 per ton, for which neither of the enterprises will get any profit. I say, "you acquire mine, or I acquire yours." At last, we acquire the cement plant from Conch. In the second half of the year after the acquisition back, we soon earn the premium money. Without the malicious competition, the cement price rises from RMB200 back to RMB300 per ton. In fact, if you think about it carefully, the person who initiates the acquisition may pay more money, but the price will definitely be restored after the acquisition. If the price is not restored, the acquisition will fail. Therefore, for the acquirers, there are two dead ends. One is that the price does not rise after the acquisition. If so, how can you recover all the money you spent? The other is that new plants are built nearby after the acquisition. You cannot acquire all of them. In China, such circumstance happens. When you just acquired the plant in front of a mountain, and a plant behind the mountain has been built. Such circumstance may recur around the mountain. However, when you acquired all the plants, you might find that one cement plant is enough to meet the demand in the place. Then, what shall you do? It's also circumstance that I often worry about. Fortunately, the state has begun to restrict the addition of new plants, which has done me a great favor.

Fourth, we shall prevent risks. Business comes with risks. I used to write a paper before, How to Prevent Risks. You Harvard students all know that risks are objective, and they co-exist with profits. Risks may be seen as a double-edged sword, which means that profit is the boundary to suppress and stabilize risks. If a variety of stock is issued in Hong Kong or the United States, there will be about 15 pages of risk description in the 100-page prospectus. If there is no risk description in the prospectus, no one will dare to buy your stock, nevertheless, if there is too much risk description, for example, 30 pages of risk description are included in a 100-page prospectus, the potential shareholders will also be scared. Try to disclose the known risks. Acquisition is risky, but I suggest that risks shall be controllable and bearable. Once the risks occur, they shall be controllable and bearable without global malicious influence. An over-blown bubble will explode, which is a kind of risk we cannot permit. Our risks shall be limited, and what is the way to locate and cut the risks? Once there is a risk, we shall cut it immediately. If we have a firewall, we turn it off immediately. If the explosion should occur definitely, it can only blow off a part rather than the whole.

Another important point is that the reorganized enterprises shall accept the group's culture. This is the bottom line. In the process of reorganization, everything can be discussed, studied, bargained and profited. But there is one point that cannot be discussed, i.e. culture. If you want to come in, you have to accept the culture of China National Building Materials Group. We can't be disordered in culture. If we operate in different rhythms, the group will be damned. Everyone shall accept the core values of the enterprise, and we will not give in on this issue. Any enterprise reorganized by us has to hang the brand of China National Building Materials Group, and wear the LOGO of China National Building Materials Group to express their sense of identity, which is of great significance. If such problem is not solved, the employees in the reorganized enterprise will not be resolute, who can't do anything. A lot of people asked me, "Chairman Song, what are the leaders like in the enterprises you have acquired? Will they all be local magnates? Are they rich and proud?" I said, "no, you can attend the annual meeting of our enterprise. They sit down there neatly and take notes." Why? The cement merchants are all billionaires. What they operate is not a small private enterprise, and they are all young and energetic after tempering in the market. In the United States, we all know that billionaires are willing to be professional managers and politicians even if they are rich. However, in China, if they suddenly become rich, will they still serve as professional managers? I doubt about it at first, which is also my experiment. I find that there is no difference between Chinese and Americans. Although they make a lot of money, they are willing to serve as professional managers. They will get up at 6 o'clock and go home at 12 o'clock at night. They still work in the plants on Saturdays and Sundays, and sometimes they treat their guests with their own credit cards. They drive their own Mercedes Benz and BMW to their workplace, and they are still very active. I think it's very good. Culture is very important, so when we reorganize enterprises, we need to talk about culture. When I talk about culture, I will repeat one thing. I take off my company logo and tie it to their suits by myself. This is my habitual action. It means that they accept the culture of China National Building Materials Group, which is very important.

Of course, China National Building Materials Group has also done a series of integration work. When I started operating South Cement Company Limited which was reorganized in Zhejiang as I mentioned, we held the founding conference in Shangri La in September 2007. General Secretary Xi was Secretary of Shanghai Municipal Party Committee then, but he had already arrived in Beijing to prepare for the 16th National People's Congress of the Communist Party of China. He wrote us a congratulatory letter. The leaders of Shanghai Municipal Party Committee announced it on the spot. The congratulatory letter is well written, concise and comprehensive. Today it still seems very penetrating. I will show you how good the letter is. He said, "I wish you to achieve the set goal of strategic integration, constantly explore new paths for the reform and development of state-owned enterprises, and make greater contributions to promoting regional cooperation and joint development.". General Secretary Xi took charge of the administration in Shanghai for seven months. I heard that he only wrote two congratulatory letters, including the congratulatory letters to us. He supported our reorganization of cement enterprises.

They asked, "Chairman Song, have you ever encountered any problems?" "Yes", replied I. In 2007 when South Cement Company Limited was reorganized, the stock of China National Building Materials Group rose to HK$39. In 2008 when the financial crisis started to sweep the world from the subprime crisis in the United States, our stock fell greatly. Can you imagine how much was our stock then? HK$1.4. A Hong Kong newspaper reported that if the stock price of China National Building Materials Group fell to HK$0.5 tomorrow, the company would collapse. I was under a great pressure then, but when I went to work, I smiled at everyone and said, "our company will make a lot of money, because someone is doing the short selling against us. Don't worry." My daughter worked in an investment bank then, and she told me, "dad, don't be so upset. You should have the mental preparation on the day when you went public. HK$39 is also given by the market. You should admit the possibility of HK$1.4 or even lower price because the company has gone public. You should have the mental preparation on the day when you decided to go public." I found that my daughter was more market-oriented than I was, and knew the capital market better than I did. Of course, our stock rose again later. Many people made a lot of money by buying it with HK$1.4. What did I do when being haunted by the urgent atmosphere? I gathered all the leaders and integrated the management. When the threats were so imminent, we read and learned in office. We could do nothing in that period indeed. The infrastructure construction stopped and the stock fell like that. Our leaders gathered to learn how to integrate the management and manage the enterprise. China National Building Materials Group proposed the integrated "eight major management methods" and "six star enterprise". This is the secret of success inside our enterprise. It is not available for publication, but for the leaders to learn in the enterprise. If you need it, I will dispense it here. Let me present you two examples.

Example I: Cost and Profit of Price

What you are learning is "cost and profit of amount". What is "cost and profit of amount"? Selling more products can reduce the fixed cost of each product and make profits. But in the case of surplus economy, 100,000 cars produced can be sold out, while 200,000 cars produced cannot be sold out, and 100,000 of them will be put in the warehouse, which not only fails to reduce the fixed cost of each product really, but also reduces a large amount of current capital. Therefore, in the case of surplus economy, "cost and profit of amount" is invalid. If you lower the price today, your competitors will retaliate at the same price tomorrow. Under a circumstance of the same low price within two days, the supply-demand relationship is still not changed, because the price is not elastic. There is no elasticity for cement price, and thus this method shall not prevail. Then, what to do? We proposed "cost and profit of price". "Cost and profit of price" refers to reducing costs and getting profits when prices are stable. How can we fix the price? The price is objective and fixed by the market, which is actually a myth. A German author, Herman Simon, wrote Invisible Champion and Confessions of the Pricing Man: How Price Affects Everything. He thinks that enterprises must highlight price, so we put forward "cost and profit of price". We shall reduce the cost when the price is stable, instead of doing it blindly. In the case of financial crisis and surplus, we shall not blindly reduce the price in large amount, because the amount can't be consumed. Everyone knew it, but they cannot manage it. The price varies every day, so we need to reduce the output and stabilize the price. With the output reduced, the price will be stabilized. If we reduce the price by 5% at this time, we will lose 20% of the profits, and the enterprise may be in the red. In contrast, if we reduce the output by 20%, we will merely lose 5% of the profits. The enterprise may earn a small profit and can go through the most difficult time. You are able to make models. Calculate it and see whether it goes that way. Herman Simon offered consulting service to more than 10,000 enterprises and earned a great deal of money.

At present, the capacity utilization rate of cement in China National Building Materials Group is only 60%. I tell our leaders to enjoy the pleasure during production, have more holidays (one month in Spring Festival, half a month in May 1 and half a month in October 1), so that our workers can live happily as the professors do. Why should we have to let everyone go to work on December 30 of the lunar calendar? We experienced the shortage economy in the past, while now what we are experiencing is a surplus economy. Under such circumstance, why should we let workers do that way? We can produce as much as the market demands by the means of defining the output according to the demand of market. The method adopted by Toyota is "zero inventory". I went to Toyota a dozen years ago. Last year, when I went to Toyota, they still insisted on the old methods, i.e. Kanban management and zero inventory. There is no warehouse for Toyota's spare parts. I estimate that it is a rectangle space with a width of about 5-6 meters right next to the production line, which is used to store spare parts produced within 2 hours. The newly assembled cars are transported directly to the port and sold out. It has no inventory following the defined out according to the demand of market. This is what I often tell everyone to change their business thinking.

Example II: "Three-Jing" Management

The first is "simplified (jingjianhua in Chinese) organization", which is about reducing levels, institutions and redundant staff. In fact, our central enterprises have been doing this way for years. Last year, private enterprises encountered great problems for two reasons. On the one hand, deleveraging and pumping. There are so many "fishes" in our "water". The "water" is too much. No matter how the "water" flows in, the existence of shadow banks just provide off-balance sheets. Anyway, they keep so many "fishes". However, we think that the phenomenon is not good. The "water" is illegal. We need to pump some "water" out. Then, what about the "fish"? Therefore, you saw some problems arising last year, we changed deleveraging into stabilizing the leverage to help the enterprises get through the difficulties. On the other hand, due to the existence of shadow banks, the private enterprises get off-balance sheet funds. The private enterprises also make the mistakes our state-owned enterprises used to make before. They also feel ambitious when the enthusiasm comes to them, and thus they want to mortgage, loan and expand their enterprises. Why could state-owned enterprises do it last year? In recent years, Premier Li Keqiang has been asking state-owned enterprises to keep "slim". Three things shall be done to keep "slim": first, it is to simplify the hierarchies. A few years ago, how many hierarchies were there in individual enterprises at its maximum? I don't think any of you can imagine it. It's 10. When there are 10 hierarchies in an enterprise, no one can manage the enterprise. All of you must have done the game of spreading a word. Song Zhiping says 1, however, when the word 1 reaches the 10th person, it might become 100 or 0.1, so the hierarchy must be simplified. Second, it is to reduce the number of enterprises. Were there too many enterprises, you would handle too many matters. God knows how many problems in the enterprises are on the way. As soon as I go anywhere other than Beijing, everyone says, "Chairman Song, I am your subordinate". Then I will ask them, "Which part do you mean? China National Pharmaceutical Group Corporation or China National Building Materials Group?" The answer is China National Building Materials Group. Then, I will ask, "Which enterprise of China National Building Materials Group? Cement, new building materials or anything else?" There are so many enterprises. Therefore, for "Three-Jing" management, level reduction, organization simplifying and redundant staff laying off, an enterprise must be simplified. China National Building Materials Group made it. The current enterprise hierarchy includes 4 levels, the number of enterprises has been reduced by 400, and many of the redundant staff has also been laid off.

The second is "fine management", that is, to reduce costs, improve quality and increase varieties, which shall be done inside the group. We are majored in management. The MBA school teaches you the courses concerning management. I have been a member of China National MBA Education Supervisory Committee for three sessions, i.e. Session II, Session III and Session V. I am still in the post now. There are 37 members in the China National MBA Education Supervisory Committee, and 34 of them are academic, including the deans for Guanghua School of Management in Peking University, Tsinghua SEM, etc. The other three are entrepreneurs like me. I have been serving the committee for 15 years, so I have a better understanding of MBA teaching. I also give lectures in Guanghua School and National School of Development at Peking University in Peking University. I serve as their professor. I give lectures once a year. I know more about the people majoring in management like us.

The third is "lean management". Why shall I raise such question? Because many of the leaders in our enterprises, including those majoring in management, teach you about the management inside enterprises, which highlights efficiency. As commented by Drucker, management means doing the right thing with an objective to improve efficiency; operation means doing the right thing with an objective to improve effectiveness. He said that effectiveness is actually the benefit. The most important thing for us to do business is to make money. If we can't make money, we as the operators are basically unsuccessful. We come here and become an MBA student, in fact, to learn how to make money, which determines whether we can start a business, whether we can become "unicorn", and whether we can be employed as a senior staff in a large company. What we want to learn here is the techniques to make money. Since the beginning of the industrial revolution, however, we have been actually summing up the management experience. In our school, management tends to teach you to deal with the relationship between human, machine and materials, which is not completely right. Now, what I'm going to teach you is about how to make money. It's a business problem. Concerning such problem, we shall look beyond the enterprises and study the uncertainty of the environment: "market change, innovation, new business model", etc., which are the most important. I lecture on Operation Methodology in school, and I tell the students that the top leaders shall assign more management tasks to their assistants in specific departments, and the leaders shall travel around to see the advancement in the management field. I went to MIT this morning and found it fruitful. In fact, all the leaders of large enterprises in China shall come here for a visit and exchange.

V. Mode Replica: Construction of Two Fortune 500 Enterprises

You will say, "Chairman Song, is your mode replicable? Does the mode make sense?" I assure you, "it makes sense." I replicated the same mode in China National Pharmaceutical Group Corporation. In 2009, SASAC suddenly appointed me as the top leader in China National Pharmaceutical Group Corporation. I was leaving for the UK to do a roadshow. On my way to the capital airport, SASAC suddenly called me and said, "Chairman Song, where are you?" "On my way to the airport. I'm leaving for the UK", said I. "Can you come back?" "What' happened?", I asked. "You shall come back right now." Then, I went back. It was a big deal. My leader told me about what happened and said that they decided to appoint me as the top leader in China National Pharmaceutical Group Corporation simultaneously. Was it feasible? I agreed in a fog. Then, I got back to the airport and caught the plane. I got on the plane and thought what we had talked about? Why they wanted me to be in charge of China National Pharmaceutical Group Corporation? The business of building materials has nothing to do with the business of medicine. When I arrived in London, the first thing I did was to turn on the computer and check what kind of company the China National Pharmaceutical Group Corporation was. It turned out to be a small company similar to China National Building Materials Group. When I came back, I began to operate China National Pharmaceutical Group Corporation. I operated China National Building Materials Group and China National Pharmaceutical Group Corporation simultaneously as the chairman in both of them for five years. During my five years of operation in China National Pharmaceutical Group Corporation, I replicated the mode used in China National Building Materials Group to it. Nevertheless, the reorganization by China National Pharmaceutical Group Corporation was targeted to the pharmaceutical distribution system rather than pharmaceutical factories, which established the national "Sinopharm Network". As you know, there are only three big companies in the United States doing pharmaceutical distribution business, while there are 20,000 companies in China. The great number of companies find their business in hospitals. Few of them have qualified warehouses. It is imaginable how many unqualified drugs there are. Therefore, the country needs a national pharmaceutical distribution network. Then, who shall be in charge of it? China National Pharmaceutical Group Corporation. Therefore, I integrated the Sinopharm Network of 290 prefecture-level cities in China with the same mode of capital and reorganization. The Sinopharm Network was listed in Hong Kong at first. After getting the money, we carried out the domestic reorganization. The reorganization was targeted to the top three enterprises in the local areas, leaving 30% of shares to the private enterprises. More than 600 enterprises were reorganized into the current China National Pharmaceutical Group Corporation successively. Last year, China National Pharmaceutical Group Corporation also achieved a sales revenue of RMB400,000,000,000.

I tell you such things to validate that these methods and thinking patterns are not only applicable to China National Building Materials Group and China National Pharmaceutical Group Corporation, but also to many industries in China.

Limited by the time, I shall stop now. Actually, I can continue for another two hour. But It has been six o'clock now. It's time for you to go back and have your dinner.

Thank you all!

宋志平在哈佛大学图书馆

//

来源:中国建材集团